For many of us, even though we are working hard and earning a regular wage, we can find ourselves short of cash.

Emergencies can crop up at any time. We might suddenly have to deal with an emergency household repair because an essential item has broken down, or maybe an unexpected bill has cropped up that needs urgently dealt with.

Whatever the reason, if you find yourself short of cash, it's best not to get stressed. Try not to panic. There are always options available to you, and ways you can deal with your finances that will ease the burden, reduce the stress, and address the problems.

Payday loans are an excellent way of accessing cash quickly if you find you need money urgently. They are short term loans, so most of them will only last a few weeks until you are next paid. Think about whether this is an option for you, it may be. Be careful to work out how much you need to borrow, how much the loan will cost you, and how much you will need to repay. Once you have established this figure, you'll know whether you can afford to use a payday loan to help you until you receive your wage.

Good lenders will advise borrowers not to use this form of credit if they are struggling with longer term financial problems. Long term debt, overdue bills, or defaults on other forms of credit are all longer term financial issues that you may need to get credit advice about. Using another loan to deal with old loans could put you and your family into a debt spiral that it may be extremely difficult to get out of.

Payday lenders are private lenders who have created a short term form of credit so people can access the money they need quickly. Short term lenders operate within strict legal frameworks and must be licensed to lend money. All private lenders must adhere to the same guidelines for lending that banks adhere to. They are guidelines which protect the consumer and the lender. Good lenders will clearly state the interest rates and fees associated with a loan.They will also give potential borrowers all the information they need, with no obligation to submit an application until they are ready to do so.

Being short of cash does not mean you are an irresponsible person. And using a Payday loan is a perfectly acceptable, legal way to access credit and deal with a cash shortage. While short term loans may not be the best option for everyone, there are millions of hard working people every year who benefit from a payday loan. And there is no reason why you can't benefit from this type of credit too, if it is the right choice for you.Care should be taken to ensure the loan is repaid fully on the specified date, or the interest rates and late fees can start to mount up. But if you borrow the money, and repay pay it when agreed, there will be no problems at all.

It is not advisable to use additional credit facilities to pay for older debts or loans as this will compound the debt, and put you into further financial difficulties. Think about how much you can afford to repay, and why you want the loan,then think carefully about borrowing before you submit an application.If you are unsure, you can speak to a customer representative, or if you are struggling financially, you may benefit from the advice of a debt advisor.

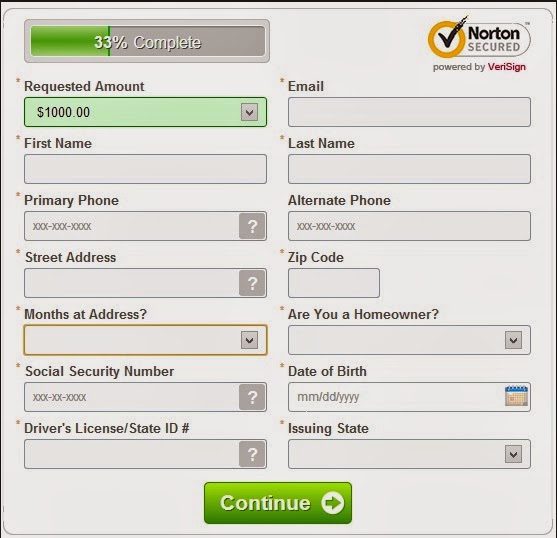

The secret to getting the best out of payday loans is to work with a reputable lender who operates fair lending practices. Ask for all the information you need, including your rights and responsibilities, and the fees and charges. Do your calculations, and then when you feel comfortable, you can apply for the loan. In most cases, you will have the emergency money you need within the hour.

Emergencies can crop up at any time. We might suddenly have to deal with an emergency household repair because an essential item has broken down, or maybe an unexpected bill has cropped up that needs urgently dealt with.

Whatever the reason, if you find yourself short of cash, it's best not to get stressed. Try not to panic. There are always options available to you, and ways you can deal with your finances that will ease the burden, reduce the stress, and address the problems.

Payday loans are an excellent way of accessing cash quickly if you find you need money urgently. They are short term loans, so most of them will only last a few weeks until you are next paid. Think about whether this is an option for you, it may be. Be careful to work out how much you need to borrow, how much the loan will cost you, and how much you will need to repay. Once you have established this figure, you'll know whether you can afford to use a payday loan to help you until you receive your wage.

Good lenders will advise borrowers not to use this form of credit if they are struggling with longer term financial problems. Long term debt, overdue bills, or defaults on other forms of credit are all longer term financial issues that you may need to get credit advice about. Using another loan to deal with old loans could put you and your family into a debt spiral that it may be extremely difficult to get out of.

Payday lenders are private lenders who have created a short term form of credit so people can access the money they need quickly. Short term lenders operate within strict legal frameworks and must be licensed to lend money. All private lenders must adhere to the same guidelines for lending that banks adhere to. They are guidelines which protect the consumer and the lender. Good lenders will clearly state the interest rates and fees associated with a loan.They will also give potential borrowers all the information they need, with no obligation to submit an application until they are ready to do so.

Being short of cash does not mean you are an irresponsible person. And using a Payday loan is a perfectly acceptable, legal way to access credit and deal with a cash shortage. While short term loans may not be the best option for everyone, there are millions of hard working people every year who benefit from a payday loan. And there is no reason why you can't benefit from this type of credit too, if it is the right choice for you.Care should be taken to ensure the loan is repaid fully on the specified date, or the interest rates and late fees can start to mount up. But if you borrow the money, and repay pay it when agreed, there will be no problems at all.

It is not advisable to use additional credit facilities to pay for older debts or loans as this will compound the debt, and put you into further financial difficulties. Think about how much you can afford to repay, and why you want the loan,then think carefully about borrowing before you submit an application.If you are unsure, you can speak to a customer representative, or if you are struggling financially, you may benefit from the advice of a debt advisor.

The secret to getting the best out of payday loans is to work with a reputable lender who operates fair lending practices. Ask for all the information you need, including your rights and responsibilities, and the fees and charges. Do your calculations, and then when you feel comfortable, you can apply for the loan. In most cases, you will have the emergency money you need within the hour.

No comments:

Post a Comment